Want to start making Money trading stocks?

Sign up today for only $40 dollars a month to access our Professional Stock Market programs.

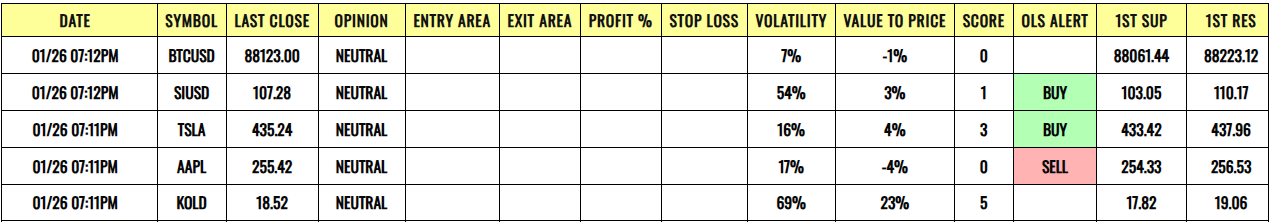

Members page Summary Sheet

Track your own stock watchlists using the Members Page Summary Sheet

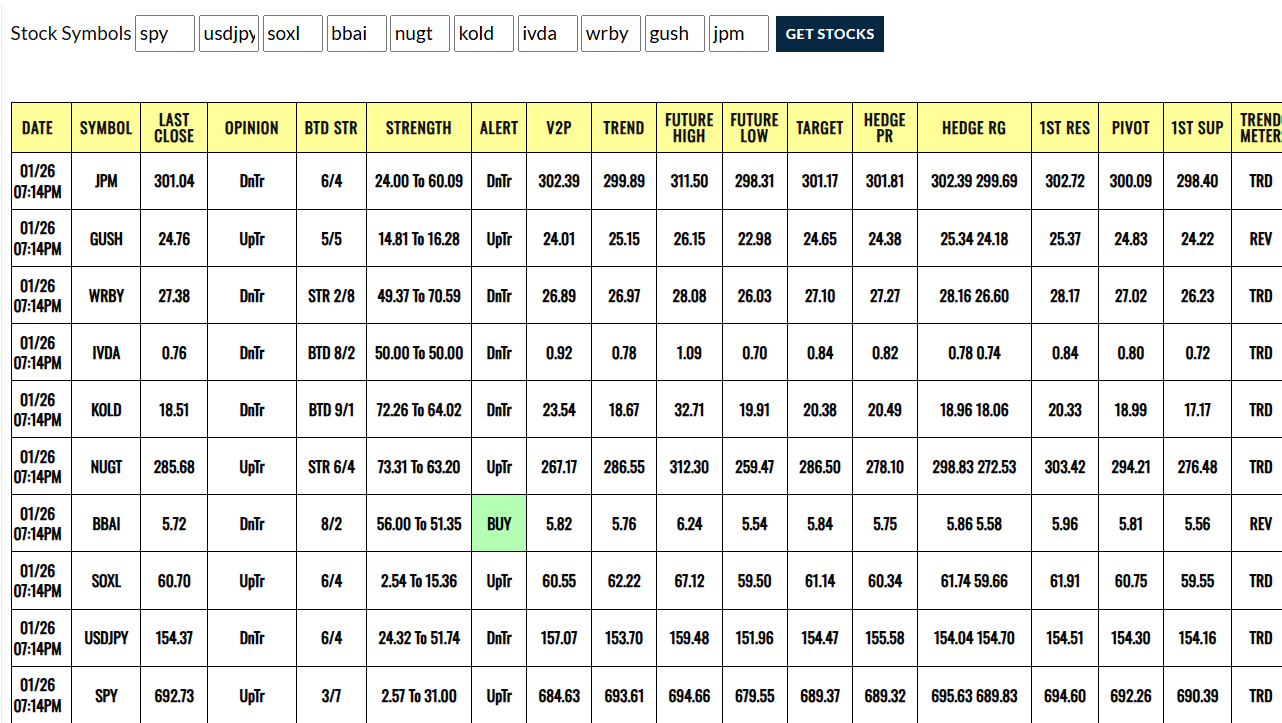

Money Maker Scanner 5 mins to Monthly time intervals,

Great tool for Day Trading or Swing Trading

OLS Scanner 4 hour interval

Zero in on the 4 hour timeframe to find Buy and Sell indicators with levels for great day and swing trading opportunities by using the OLS scanner.

WLS Scanner

Use this Watch List Scanner to create your Watch List of the favorite stocks. Track them with daily or regular scans to locate those great buy and sell areas to make you money.

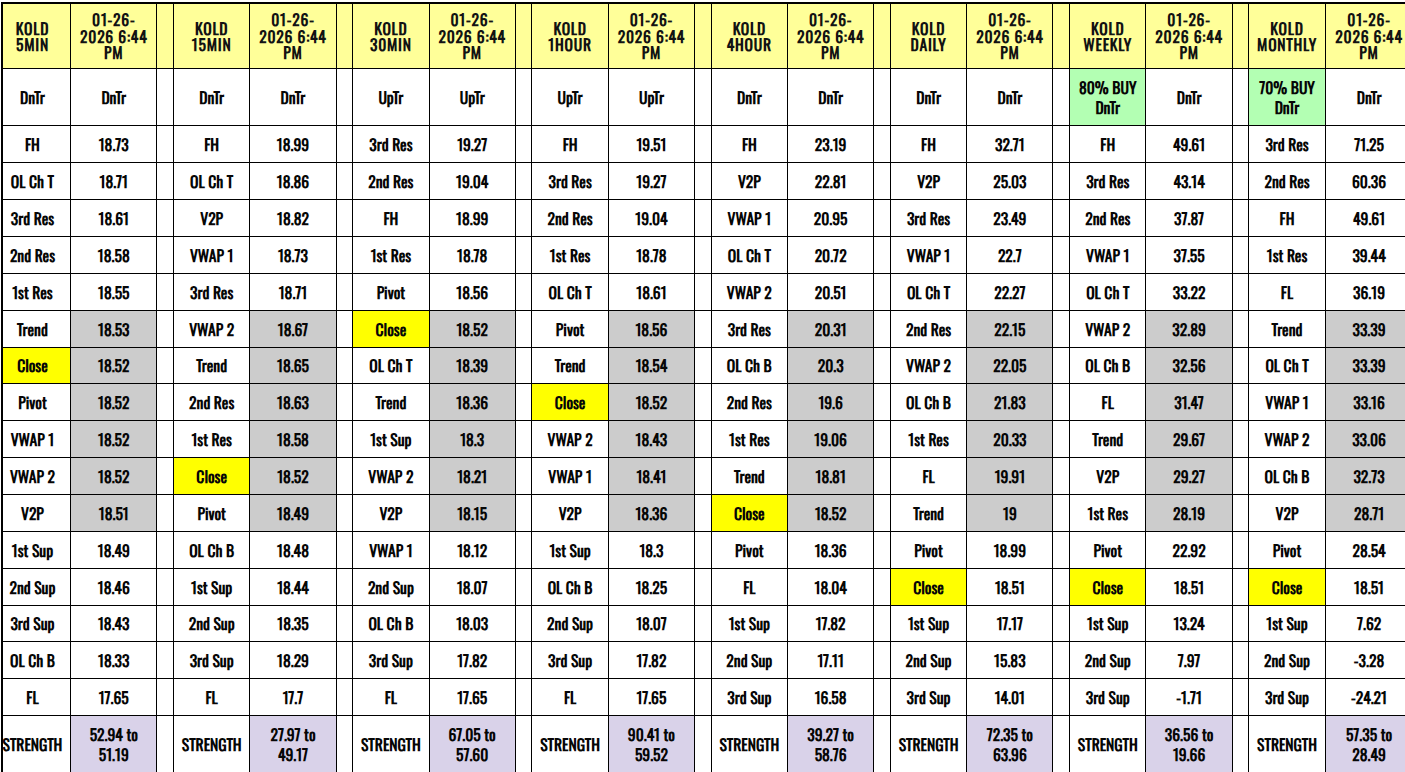

Analyzer

The Analyzer is a comprehensive look at timelines from 5 minutes to a Month. This will show direction, expected price action and provide trading opportunities ranging from Day Trading to Buy and Hold investments. The program Analyzer is a complete tool for your trading journey.

Click on the Subscription tab to sign up for access to our Stock Analyzers!!!

Our team at OutLawStocks has spent years of intense hard work building our Market Program Analyzer. It is a computer application that utilizes fine-tuned formulas to analyze data to provide the direction the stock is heading the next day and predict its future forecast. This could be the perfect program for your trading style.

OutLawStocks Program:

Our program uses a technical formula that analyzes the current and historical price activity to predict future price movements and identify high-probability trade entry and exit levels, providing investors and traders with a dynamic view of the market direction. We display each stock on a summary sheet, making it easy for the trader to view.

What We Provide:

With a Paid subscription to OutLawStocks, you will have access to our (All 5 of our Scanner pages) , allowing you to input symbols into our program to create a summary sheet for each stock. It offers an advantage for all types of traders, whether long or short, from day traders to option traders.

This gives the investor the edge he or she will need to tell what price range and direction the chosen stocks will head the next day and in the future. We have been tracking and testing our program with very good results.

Three Simple Trading Rules To Follow:

1. Know your Entry Price

2. Know your Exit Price

3. Know your Stop Loss Price

Stick to these three rules don’t get greedy

Disclosure & Disclaimer – All information provided is for informational purposes only, not intended for trading purposes or advice. Neither OutLawStocks.com nor any of independent providers are liable for any informational errors, incompleteness, or delays, or for any actions taken in reliance on information contained herein. By accessing the OutLawStocks.com site, you agree not to redistribute the information found therein. Do your own research and due diligence.